Zero share data: Towards a new consumer privacy paradigm

StJohn Deakins, founder of Datasapiens, on "fostering more personalised and participatory relationships between businesses and customers".

Corporations are hungry for customer insights. But as regulators become ever more zealous and the GDPR still looming large, storing the data that contains that vital intel is like locking away a ticking time bomb which could explode at any time, taking billions of dollars of revenue with it.

Consumers are also thirsty for personalised service, relevant offers and a more useful relationship with brands - yet are often justifiably uncomfortable with handing over the personally identifiable information (PII) required to meet these expectations.

The way to bridge this gap, according to StJohn Deakins, CEO and Co-Founder of Datasapien, is a new concept called "zero share data". I have been deeply inspired by Deakin's work for many years, particularly CitizenMe, a "data platform for humanity" that enables consumers to take control of their data and earn money directly by selling it on their own terms to businesses. This idea is part of what inspired the mission behind Machine, which was founded to explore a cooperative model for journalism that shares revenue with readers.

I wanted Deakins to be the first major interview for Machine to discuss a revolution in which brands and consumers are forming new relationships based on trust and openness - values that will be reflected throughout the life of this publication as we push forward with collaboratively developing the Payeewall, a mechanism for sharing revenue with loyal readers. We started by asking him about the mission behind Datasapien, which delivers rich, raw and useful data to companies whilst ensuring consumers' privacy is protected.

A new approach to consumer data

Machine: What is zero share data and how does it fit in with your wider mission?

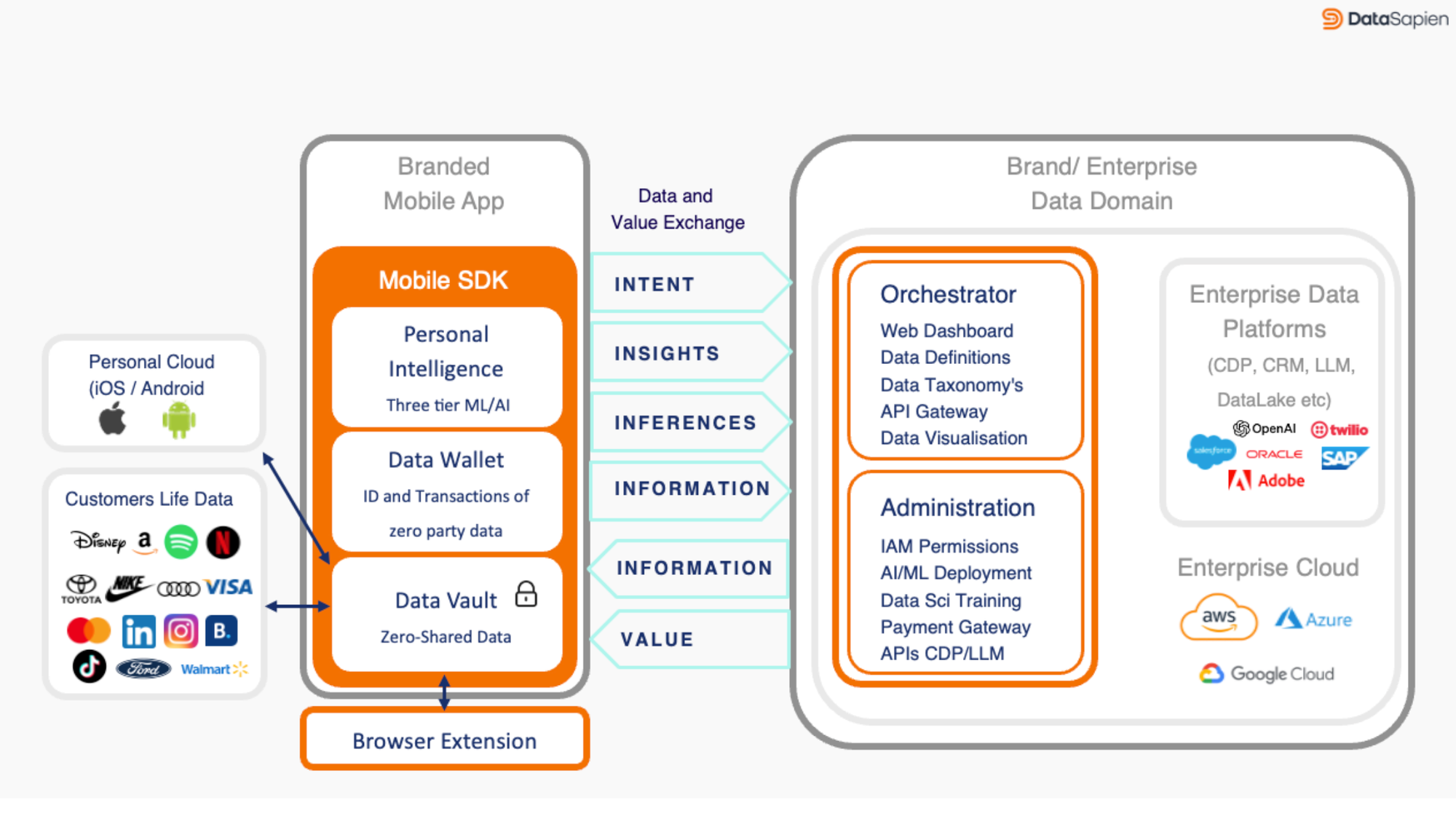

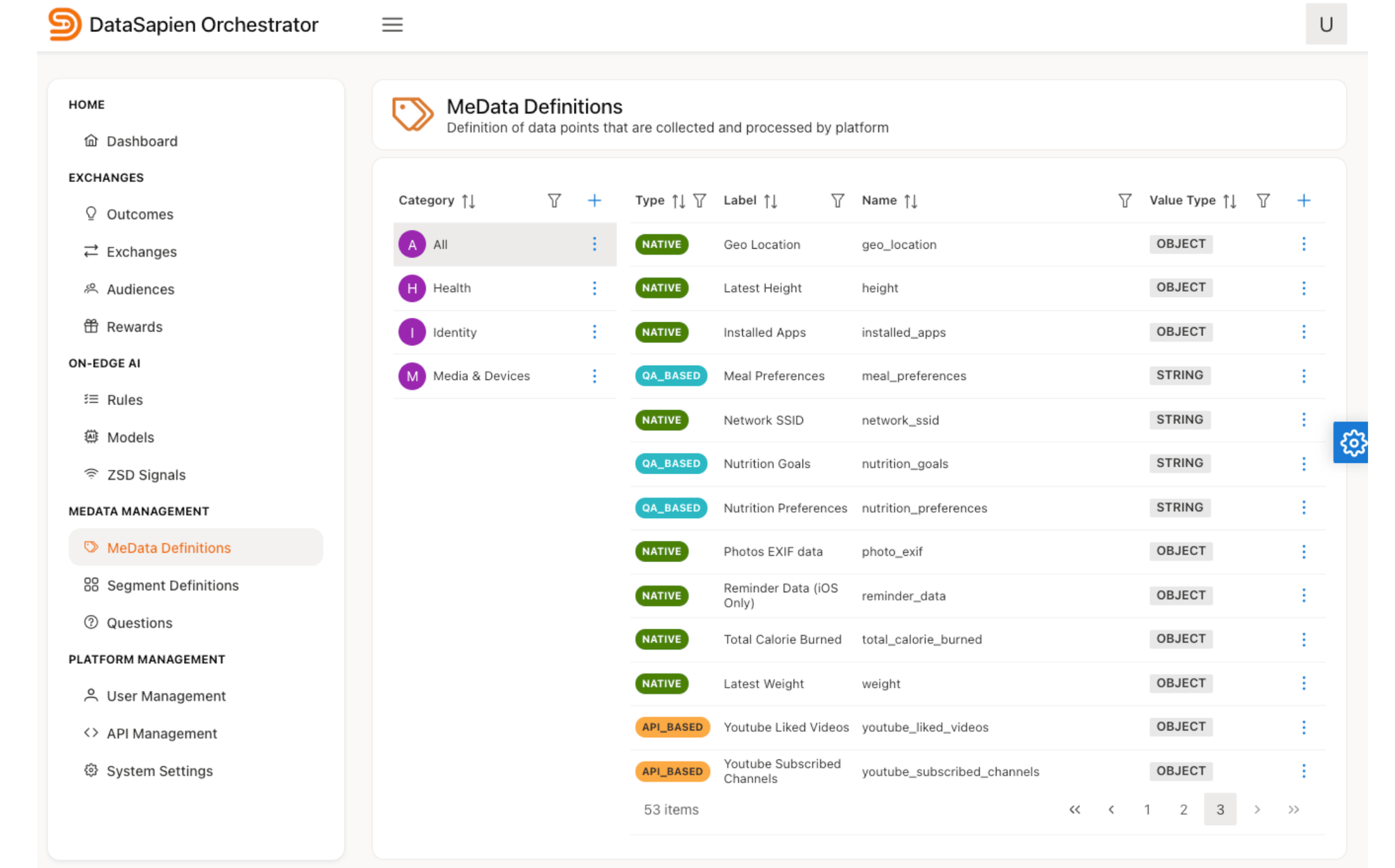

John Deakins: "We developed the concept of zero share data to ensure that your data remains stored locally on your smartphone or within a personal domain. Instead of sending your data elsewhere, we bring AI to your data. This approach ensures data remains in the control of users. Personalisation is achieved by moving the algorithms to your device, so you get the benefits without having to share sensitive information.

"For large corporations, holding data is becoming increasingly burdensome. They want to deliver better personalisation and solve problems more effectively, but they don’t want to manage or store sensitive data. For example, something as simple as your date of birth doesn’t need to leave your device. The supermarket doesn’t need to know your exact birth date or even your age - it only needs to know your general age category, such as 13-14 or 45-50, to tailor its services. This information can be processed locally, and only the necessary insights can be shared.

"The broader vision of zero shared data is ambitious but essential. In a globally connected world with eight billion people online, we need governance and agency to protect individual sovereignty while enabling participation in communities, societies, and economies. To achieve this, we must empower individuals with control over their data. The digital economy thrives on personal data, so giving people the ability to decide what they share - and what they don’t - ensures a more equitable and participatory system. This shift would lead to better societies and stronger economies, as everyone can contribute without compromising privacy.

"Currently, our centralised data ecosystem is built to monetise information. Data is funnelled into centralised silos, such as social media platforms, which inherently limits its overall value. By decentralising control and enabling individuals to manage their own data, we unlock the potential for greater participation and shared benefits for everyone."

Next steps on the road to Open X

Machine: How does zero share data fit into the wider "Open" movement that started with Open Banking and pushed banks to share customers' account data?

StJohn Deakins: "The UK initially led the way with Open Banking but then lost momentum. The approach behind it is now extending to other areas. For instance, smart meters have been rolled out across the country, and everyone now has access to their smart meter data. The idea was that this data would be made open, enabling comparison sites to automatically switch you to a different energy provider offering better tariffs. However, that process has taken years to materialise.

"Open Banking happened, but Open Finance covering insurance and other areas hasn’t yet materialised, even though it was supposed to be on the roadmap. Open Energy hasn’t happened, and neither has Open Telco. So, while we led the way in the initial stages, we seem to have become a bit complacent or muddled. Hopefully the new UK government's push for fresh Smart Data legislation will get things moving again."

"Meanwhile, in the European Union, the Digital Markets Act is forcing the so-called 'gatekeepers' - six major tech companies - to open up their data. For example, thanks to this, you can now access all your Facebook and Instagram data from the past three years by changing just one setting. The EU is also pushing companies like TikTok, Google, Amazon, Microsoft, and Booking.com to comply, with plans to include other big tech companies in the next wave.

"This approach creates a marketplace by compelling companies to open their data. A simple example: if I have lots of data on Booking.com and I want to look at hotels with another provider, I can take my Booking.com data to Expedia. This allows me to get better deals from Expedia. I don’t delete my data on Booking.com; I get a copy of it, which I can use elsewhere to improve the service I receive. This approach is starting to open up markets, replacing silos and reducing attempts to lock users into specific platforms."

Privacy-focused data sharing

Machine: How does Datasapien use the concept of zero share data to give brands the information they need whilst protecting consumer privacy?

StJohn Deakins: "We provide large enterprises with the ability to embed a personal data store and personal AI into their existing customer apps. Take a typical supermarket app which offers money off the next purchase after you spend a certain amount. Currently, you also receive lots of generic coupons, many of which are irrelevant.

"We’ve done extensive research, particularly in grocery retail, and identified 25 things customers want but supermarkets don’t currently offer. The number one request is for meal planning tailored to individual preferences. For instance, someone might want Tex-Mex one week, Thai food the next, or meals that align with a specific diet. Around a third of women in the UK are on a diet in any given year, and people want meal plans that cater to dietary needs - without including allergens like peanuts, for example. Throwing such requirements at general AI could lead to mistakes, like including peanuts, which could have serious consequences.

"The idea is that supermarkets can embed our technology into their apps, enabling customers to input their data and get personalised services. For example, their shopping app can now pull data from Apple HealthKit to track daily energy expenditure and adjust meal plans if the customer wants to reduce calorie intake by 10%. It can also integrate with social platforms like TikTok, Facebook, Instagram, and YouTube to understand what recipes the user has been viewing and use them to inform the meal plan.

"Customers can add deterministic "must not include" data, such as food allergies, and the AI can process this along with other inputs to create the perfect meal plan. The app could analyse millions of recipes to generate a personalised plan for the week. That meal plan could then transform into a nutrition advisor, allowing users to take photos of their meals for tracking, effectively turning it into a nutrition coach.

"All of this happens entirely on the device, ensuring that no sensitive data leaves the customer’s smartphone or goes to the supermarket chain. The supermarket’s role is simply to fill the customer’s basket and support them through their consumption journey. Meanwhile, the customer can confidently share more sensitive data with their personal AI, knowing it will remain secure on their device.

"The app could also integrate with the user’s calendar to adapt the meal plan based on their schedule - removing a meal if they’re out on Tuesday evening, for instance. This approach isn’t limited to grocery. Take home-furnishing apps as another example. Instead of focusing on just one aspect - such as buying a sofa or managing home energy - an app could solve everything related to the home. Users could securely pull together various types of lifestyle data, which they might be reluctant to share with an energy company, and receive comprehensive advice on buying, financing, insuring, or maintaining a home.

"The same concept applies to automotive. Imagine a single app that handles everything related to cars: buying, insuring, parking, and more. Instead of juggling 15 different apps, customers could rely on one app with a personal AI that provides seamless service across all aspects of car ownership. This model addresses the challenge of managing vast amounts of data by ensuring it remains secure on the user’s device while still delivering outstanding personalised services."

The future of brand relationships

Machine: Are we living in a new era of cooperation between brands and consumers?

Stjohn Deakins: "This gets down to hard purpose. There's been a lot of purpose-washing, especially around green initiatives. I think many consumers have started rolling their eyes at it because now everything- even baked beans - has to have a “purpose.” And honestly, most people don’t care about that. However, when it comes to building trust and fostering deeper relationships, there’s a growing recognition that brands need to improve. This shift is happening across the board, including in areas like advertising, where the ecosystem is moving back towards brand advertising and building identity rather than just spamming consumers.

"In terms of personalisation, if brands want to build deeper relationships with their customers, they need to establish data trust and digital trust. That shift is certainly underway. The big opportunity for brands is the chance to be first movers in the transition towards domain-specific apps. This shift allows them to expand into adjacent markets. For example, a home finance company could branch out into home purchasing or home insurance. If a brand knows enough about someone’s home setup, it can unlock affiliate markets or expand across the entire domain, driving growth and creating new revenue streams.

"This also fosters much deeper, more personalised, and participatory relationships between businesses and customers. Big brands that get this right will benefit significantly. However, there will be many brands that don’t quite grasp the concept or fail to execute effectively. For them, the risk is becoming commoditised. If my personal AI handles everything in my home for me, and I don’t have a meaningful relationship with a particular brand, my AI will simply purchase their services or products as needed - without any loyalty or engagement."

The Payeewall and cooperative journalism

Machine: Your work has directly influenced the founding mission of Machine. I know it's a bit weird for a publication to talk about itself in an interview - but we're dedicated to working collaboratively to develop our vision. So are you fighting on the same side as Machine and what do you think of the concept of the Payeewall and cooperative journalism?

Stjohn Deakins: "Logically, giving people cash in exchange for their data creates a kind of straightforward marketplace. It’s a direct exchange, which feels fair because there’s a market rate, and individuals can do whatever they like with the cash.

"However, the downside is that it’s transactional - very clearly transactional - and less emotional. For instance, there’s a German search engine that plants trees, which resonates more emotionally with some audiences. The appeal depends on who you’re targeting.

"If you let people take cash raised from advertising, the amounts for an individual might be small, so to make it meaningful, you’d need it to accumulate over time and hit a threshold in an account. For example, after three months of reading some articles, they might have enough to make it worthwhile. Alternatively, you could give people the ability to participate and vote as a community. The challenge, of course, is verifying users as humans to prevent abuse from bots. We spent a lot of time addressing this and ultimately connected to PayPal to help mitigate that issue.

"From a more altruistic perspective, one idea could be to set up a small publication with a dedicated core of followers. Over time, you could build a network of aligned publications that share a 'giving back' ethos. You could also let the community itself decide where the collective funds are spent. For example, if there’s a pool of funds at the end of the month, the audience could vote on how it’s used.

"I think it's a really cool idea. It's so, so needed at the moment."

Have you got a story to share? Get in touch and let us know.