Money Machine: Satoshi's identity, Open Banking fears, IBM on GenAI and the real DOGE

The first edition of a newsletter sharing the latest news, insights and gossip in crypto, fintech and the financial services ecosystem.

Welcome to the first edition of Money Machine, a weekly newsletter sharing news and insights from the cutting edge of fintech, crypto and financial services.

This is also the inaugural newsletter from Machine, a publication covering tech, science and ideas that's an experiment in cooperative journalism. Founded by former Fleet Street journalist Jasper Hamill, Machine is working towards building a model that shares profits with readers. Check out our mission here.

We'll be introducing more newsletters on topics we love in the coming weeks and months, so please like, subscribe and share with your network. Please do like, subscribe and share with your network.

And be sure to get in touch with jasper@machine.news to send us news stories or enquire about our marketing services, which includes copywriting one client described as "world class" or PR consultancy and training. This newsletter will also be published here on Machine with full links. Fuck

Martin Lewis issues Open Banking warning

Here at Machine, we're outspoken champions of Open Banking, Open Finance and Open X, with deep expertise in this space and years of experience writing about it for a B2B audience.

So we were a little saddened to see Money Saving Expert founder Martin Lewis issue the following warning about Pay By Bank - an Open Banking payment option. However, Martin has a point here and has highlighted a problem which needs to be solved pronto if the Open movement is to succeed in its mission to displace cards and other legacy payments.

"Have you noticed ‘pay by bank app’ at online check-outs. It's quicker & easier but be aware there's LITTLE PURCHASE PROTECTION," he wrote on Facebook.

"It's on the likes of Just Eat and Ryanair. You don't give card details, just pick your bank, and log into its app (via biometrics) then it’s done.

"Yet ultimately, it’s just a bank transfer, so you don't get the same refund rights, like chargeback or Section 75, if things go wrong that you do when you pay by card. So, for small things (or transactions usually done by bank transfer) it’s no biggie, but beware with big purchases."

Lewis did note that it's safe to settle your tax bill by Pay By Bank. Britons sent £12 billion to HMRC using Pay by Bank between 1st February 2024 and 20th January 2025 - a significant 36% increase from the same period in the previous year. Congratulations to Ecospend, a Trustly Company, which delivered the Open Banking functionality.

Open Banking is a major UK success story with more than 11.7 million active users and over 22.1 million open banking payments made monthly. If we can get purchase protection right, the UK will be well-placed to maintain its global leadership in this exciting new(ish) financial services paradigm.

Coinbase secures VASP registration in the UK, promises to protect "economic freedom"

One of the world's biggest crypto exchanges has taken a major step forward in the UK by securing Virtual Asset Service Providers (VASP) registration.

The FCA has now officially granted the crypto firm a new regulatory status that will enable it to offer an improved range of retail, institutional, and ecosystem products and services to users across Britain. It will be the largest VASP in the UK.

In a statement, Daniel Seifert and Keith Grose wrote: "Governments around the world are waking up to the fact that crypto fuels economic prosperity. We believe that crypto is the most important technology that can generate growth in the world, and the UK is poised to benefit from this.

"This game-changing technology is set to bring remarkable rewards, spurring jobs, growth, and investment throughout the UK. We at Coinbase are genuinely excited to be part of the UK's incredible journey and the amazing opportunities this new era offers.

"We are pleased to see the UK Government recognise the potential of this industry and the way in which it can contribute to their pro-growth and innovation agenda."

Cynics might suggest that regulation tends to work against the freedom offered by crypto. But hey. Great news for Coinbase and another step towards embedding crypto within the established, regulated financial system. Get the full story here.

GoCardless gets halfway to going lossless

The UK's GoCardless has significantly reduced its losses in FY24, moving closer to profitability.

According to its newly published Companies House filing, GoCardless reported a net loss of £35.1 million for the financial year ending 30 June 2024 - a 55% improvement from the £78 million loss recorded in FY23.

Revenues surged 38% year-on-year, reaching £126.8 million, while total income, including interest and subsidiary revenue, climbed to £132.8 million.

The company’s financial performance reflects its ongoing efforts to scale efficiently as it targets sustained profitability in the near future.

Hiroki Takeuchi, co-founder and CEO, said the figures “point to a clear path to profitability”.

“We’re continuing to see the results of our increased focus on international markets and our indirect channels,” he continued,

“Our data services remain popular with customers, from helping them prevent fraud and improve conversion rates to powering essential business operations through open banking data. And with the integration of Nuapay providing the capability to send as well as collect payments, we’re well on our way to becoming a full-service bank payment provider.”

Lloyds goes big on responsible AI with key new hire

Lloyds Banking Group has appointed Magdalena Lis as Head of Responsible Artificial Intelligence, following the earlier appointment of Dr Rohit Dhawan as Director of AI and Advanced Analytics in August 2024.

In her new role, Lis will focus on "leveraging next-generation technology to enhance Lloyds Banking Group's products and services while implementing necessary safeguards and controls". She brings over 15 years of experience in AI, having previously served as an advisor on responsible AI to the UK Government and most recently as Head of Analytics and Data Science at Toyota Connected Europe.

Lis said: “AI represents a big opportunity for Lloyds Banking Group and I’m excited to be a part of the business."

Congratulations to FintechOS!

FintechOS, a finance platform provider, has been named a Challenger in Gartner's Magic Quadrant for Retail Core Banking Systems, Europe.

We admit to a special interest in FintechOS, which was one of our favourite copywriting clients. It's a super-impressive, Romania-born fintech staffed by smart, forward-thinking and highly innovative people.

Great to see it getting yet more recognition (although we're still sad they didn't follow up on our not entirely serious suggestion to print up t-shirts emblazoned with the words "Fintech Oh Yes!").

Teo Blidarus, CEO and Co-Founder, said: “By augmenting core systems, we empower financial institutions to streamline operations, enhance customer engagement and accelerate product transformation without costly overhauls. As we expand the FintechOS platform with advanced AI capabilities, we enable banks to extend their competitive advantage with iterative modernisation.”

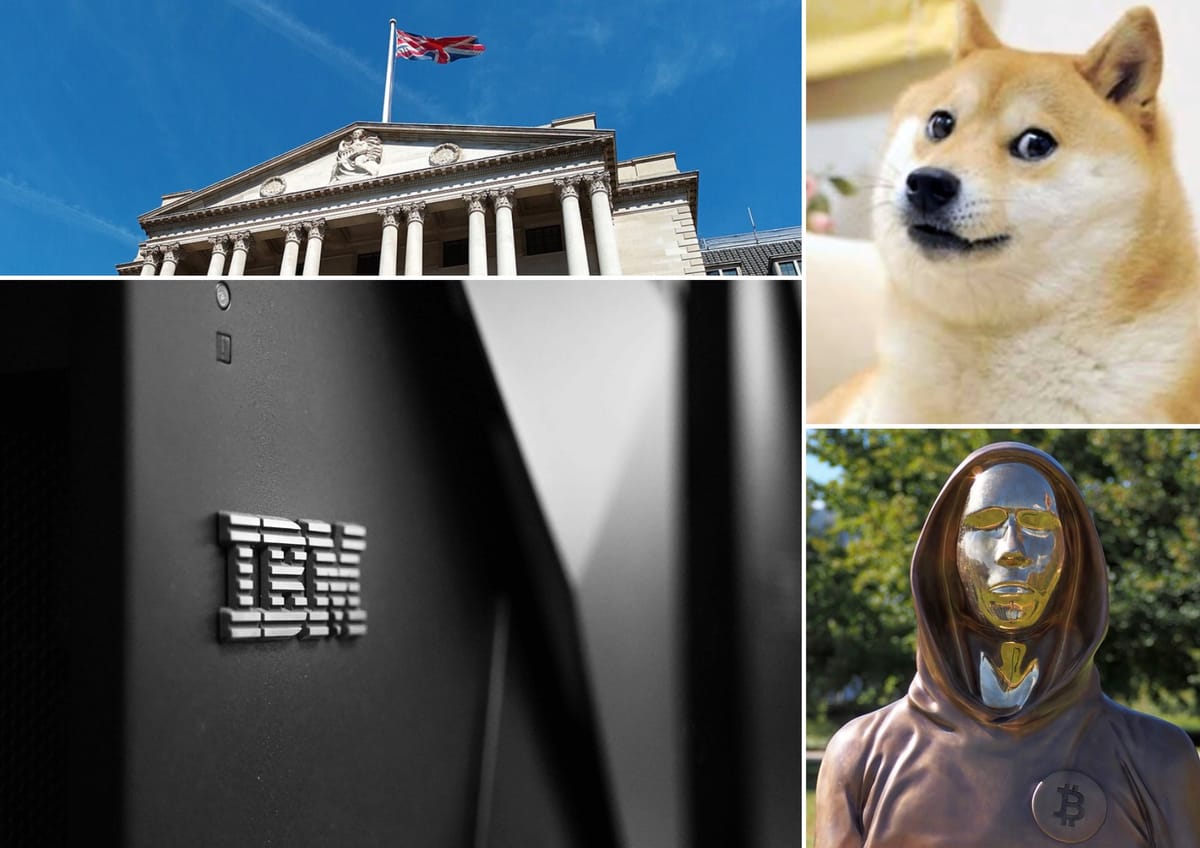

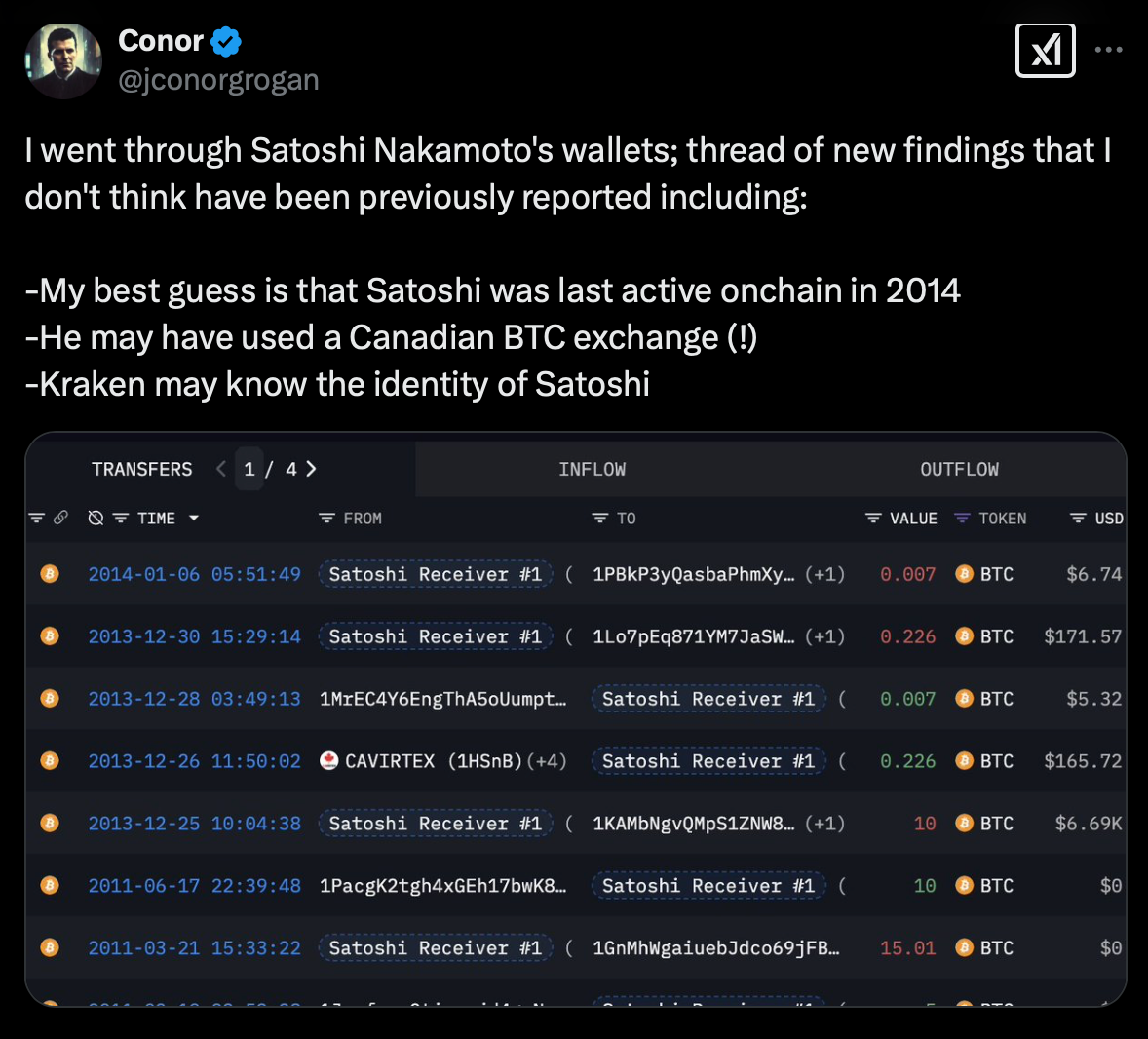

Does Kraken know the identity of Bitcoin creator Satoshi?

Coinbase director Conor Grogan has suggested that the crypto exchange Kraken may know the identity of Satoshi Nakamoto - the pseudonymous creator of Bitcoin.

His analysis of Satoshi's wallets suggested the mystery man or woman may have been active on-chain until 2014, later than many previously believed.

There is also evidence indicating that he may have used a Canadian Bitcoin exchange, raising questions about whether any records from that platform could provide further clues to his identity.

Let's hope the Kraken awakens and gives us the truth...

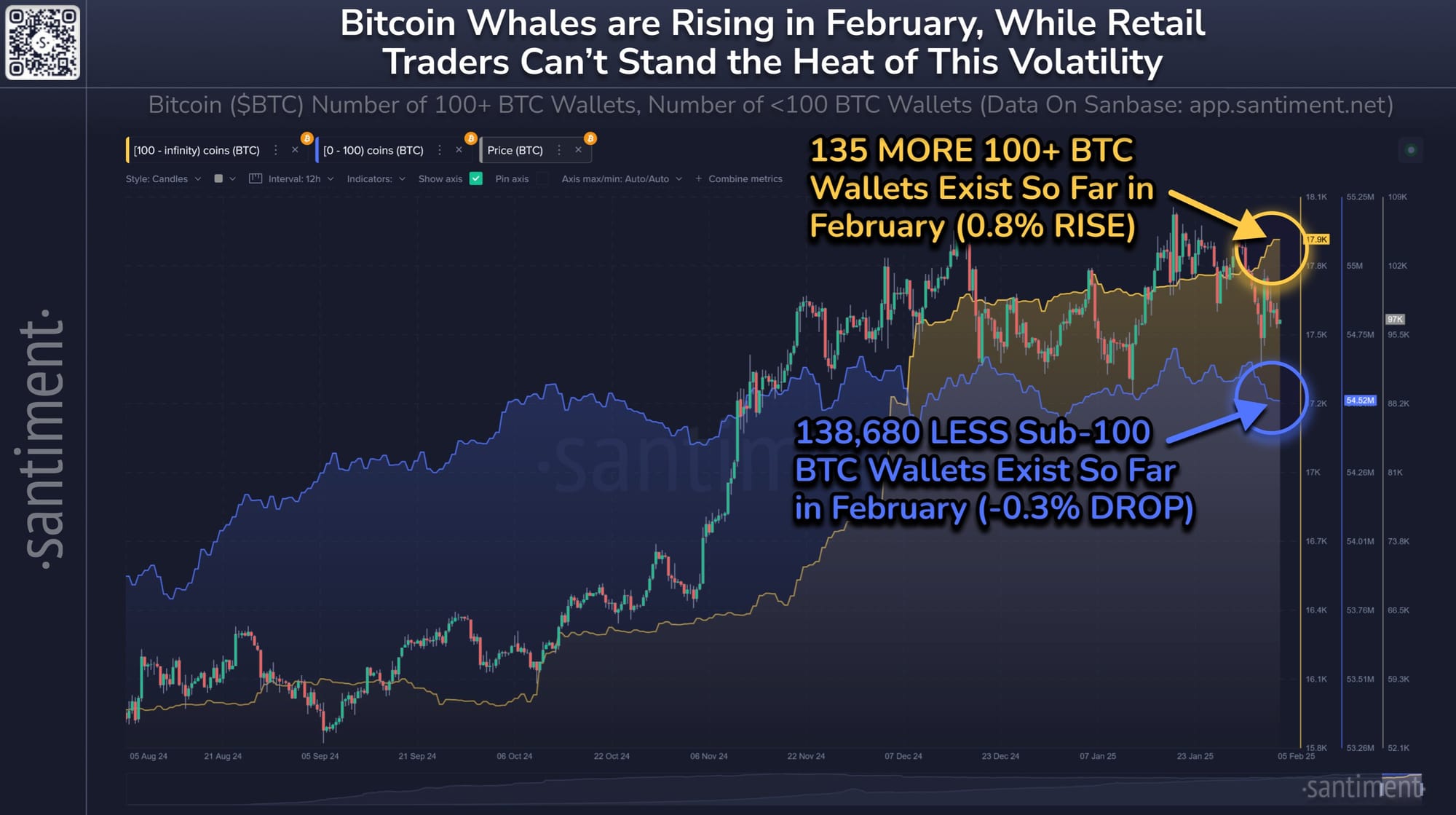

Bitcoin whales surface to buy the dip

The biggest Bitcoin investors are buying up crypto as small retail traders sell their holdings amid market volatility.

Santiment AG reports that the ups and downs in Bitcoin's price are causing ordinary folks to sell up - giving whales an opportunity to gulp down their coins.

"For small retail traders, especially the ones who first entered the markets in the past 6 months, the volatility is causing them to liquidate," it wrote on X.

"Overall, February has seen a growth of 135 more 100+ BTC wallets, and a plummet of 138,680 <100 wallets.

"This is an ideal setup for crypto market caps to rise, even if it takes a few more weeks (or even months) to see the generally bullish impact of coins being absorbed by whales."

The original DOGE bites back...

These days, DOGE is famed as the name of Elon Musk's controversial Department of Government Efficiency, which is dedicated to slicing government waste and streamlining the public sector.

But what's been happening to the memecoin which inspired its name?

Good things, it seems. Neptune Digital Assets, a Canadian blockchain company, recently acquired 1 million DOGE tokens worth almost $270,000 during a “strategic derivative purchase” on December 27, 2024, it revealed in a disclosure.

Meanwhile, a prominent investor using the pseudonym Inspired Analyst named DOGE as one of the coins which could help you achieve financial freedom, advising people to keep a close eye on the project for the foreseeable future.

It's now hoped that DOGE (the coin, not the department) will lead an "altcoin season" which is defined as 5% of the top 50 altcoins beating the performance of Bitcoin over a 90 day period.

Good luck to DOGE!

IBM is bullish on GenAI in the financial sector

The tech giant IBM has predicted that GenAI adoption will "soar" in financial services as it released a study which found that the tech will "elevate" banks' performance in 2025.

It surveyed C-suite leaders to find that just 8% of banks were developing generative AI systematically in 2024, while 78% had a tactical approach. As banks move from pilots to execution, many are now "redefining their strategic approach to service expansion, including agentic AI".

The survey found that 60% of banking CEOs surveyed "acknowledge they must accept some level of risk to harness automation advantages and enhance competitiveness".

"We are seeing a significant shift in how generative AI is being deployed across the banking industry as institutions shift from broad experimentation to a strategic enterprise approach that prioritizes targeted applications of this powerful technology," said Shanker Ramamurthy, IBM Consulting's Global Managing Director Banking & Financial Markets.

"As banks and other financial institutions around the world gear up for a pivotal year of investing in transformation, technology, and talent, we anticipate their efforts coalescing around initiatives using generative AI to level up customer experience, boost operational efficiency, reduce risks and modernize IT infrastructure."

And that's it for the first instalment of Money Machine. Please get in touch with news or enquiries about marketing or sponsorship. Visit machine dot news to see the full newsletter with links. Thanks for reading!

Have you got a story or insights to share? Get in touch and let us know.