MONEY MACHINE: Green shoots, fintech IPO forecasts and a blitzkrieg on banks as Trump awakens the Kraken

A sunny springtime outlook... with a strong chance of rain.

Spring has sprung and the green shoots of a "fintech rebound" are finally clawing up through the frozen ground. Or are they?

First, the bad news. It's no secret that the past year was pretty tough for fintech, with investment here in the UK plunging to £7.97bn - almost three billion pounds lower than the £10.95bn invested in the previous year, according to KPMG UK's Pulse of Fintech report.

Innovate Finance reported that global fintech investment slumped by 20% in 2024, with fintechs worldwide earning a total of $43.5 billion in investment compared to $54.2 billion in 2023.

Meanwhile, S&P Global Market Intelligence said the sector secured just $21.5 billion in venture capital investment last year, the lowest level since 2016. Its latest report quoted John Clark, partner at Royal Park Partners, who stated that VCs are putting their money elsewhere and said: “With AI ‘revolutionizing’ multiple industries, venture capital is flowing where the next big breakthrough is expected."

Now the good news. Hannah Dobson, KPMG partner and fintech lead, noted there has been a "slow recovery in deals" and said: "Despite the drop in investment, the UK remained the capital of European fintech in 2024, attracting almost half the entire funding of the EMEA region. We expect UK investment to remain relatively soft in the first half of this year, although it will likely begin to pick up as interest rates reduce further, with common consensus that this will be in Q3/Q4."

This is the third edition of Machine's fintech newsletter, but founder Jasper Hamill has been a copywriter and PR consultant in and around the space for almost five years (which, in fast-moving fintech time, is the equivalent of half a century).

We started writing about the sector way back then because we believe it's one of the most exciting industries in the world. So, in that spirit, here are a few reasons to be cheerful as buds appear on the branches, the birds begin to sing and the long fintech winter starts to end. But, as with every British springtime, there's a sting in the tail and a cold, sharp shower to snap you back into reality.

Visa dials up Tap to Phone growth

Visa's Tap to Phone turns smartphones into payment terminals - lowering costs, simplifying the acceptance of digital payments and eliminating the need for expensive card terminals.

Growing numbers of businesses are now using the tech to take contactless payments via NFC-enabled smartphones, with a 200% increase in usage globally over the past year and a 300% spike among British small businesses.

“Tap to Phone is the ultimate leveller for businesses,” said Mandy Lamb , managing director UK & Ireland, Visa. “That’s especially the case for new businesses starting out, that can set up shop and instantly accept payments using a mobile device they already have in their pocket. With over 18.3 billion contactless payments made in the UK in 2023 alone, it’s clear that consumers love to tap."

JP Morgan leads $10million investment in "fairness-as-a-service" pioneer

FairPlay, which describes itself as the the world's first Fairness-as-a-Service company, has landed a $10M investment from Infinity Ventures, JPMorganChase and Nyca Partners. It secured the money after a threefold increase in business during 2024.

Kareem Saleh, Fairplay CEO, said: "This investment underscores the growing importance of AI safety in the banking and insurance sectors. This funding not only validates our mission but also enables us to help more lenders and insurers make decisions that benefit their businesses and their customers."

FairPlay’s AI fairness tools help companies identify and fix decisioning blind spots, boost revenue, ensure compliance, and improve consumer financial outcomes while advancing safer AI adoption.

Which fintechs will be the next to IPO?

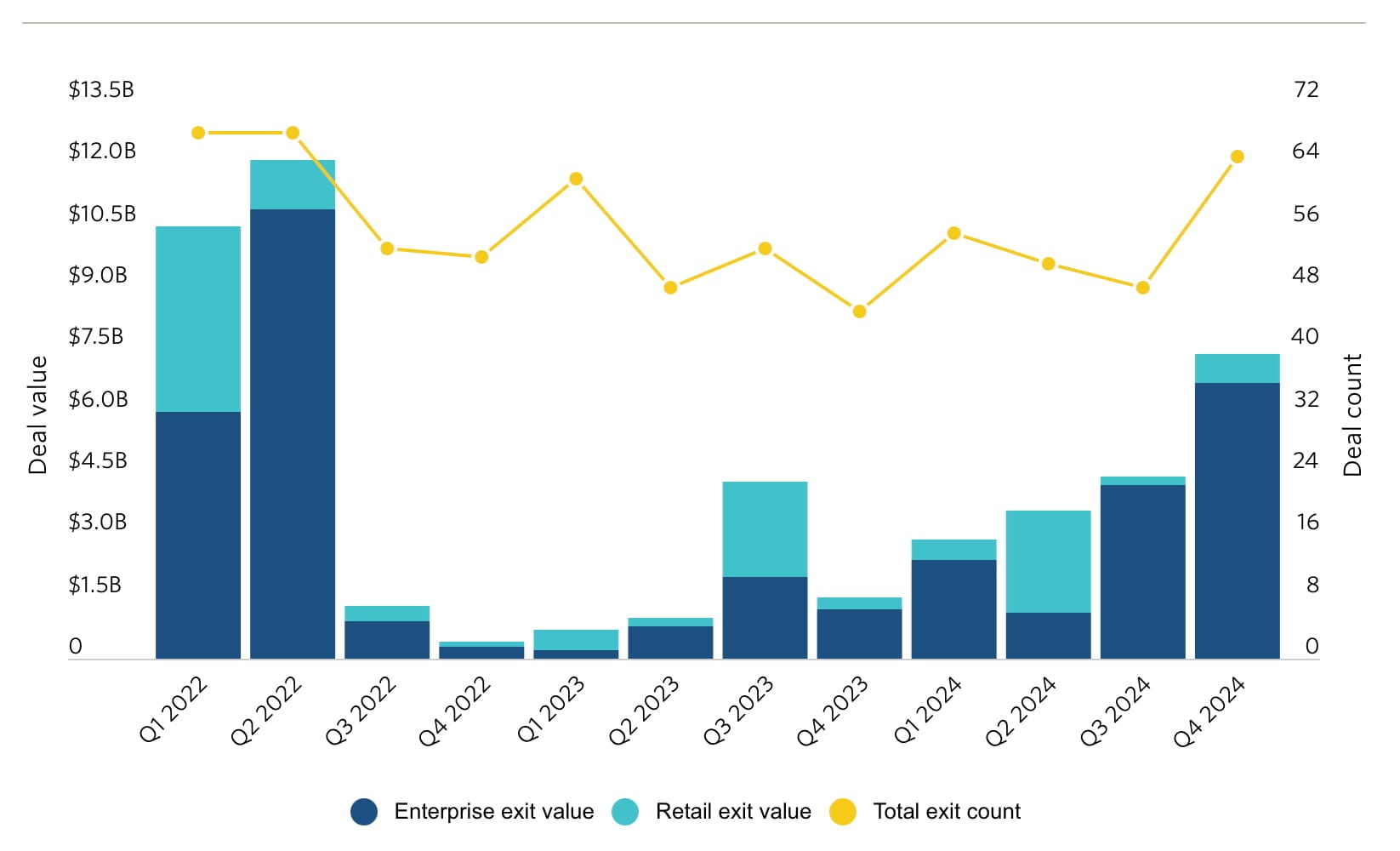

"A slight uptick in fintech VC exits toward the end of 2024 indicates the sector’s promising IPO candidates could be closer to testing the public markets."

The words of Pitchbook, which reports that global fintech VC exit activity is at its "highest level both in deal value and count" since Q2 2022—amounting to $7.4 billion across 65 exits in Q4 2024.

Last year, key exits included IPOs for ServiceTitan, Ibotta, LianLian, Digitech and BAIWANG Group.

So which companies will be next to go public?

According to Pitchbook, we should be keeping an eye on Stripe, Ramp, Gusto, Rippling, Brex, Airwallex, Deel, N26, Plaid and Revolut.

The Kraken awakens as Trump turns the tide on crypto

The SEC has dropped its case against the crypto exchange Kraken.

The SEC has recently abandoned or paused actions against a range of firms including Coinbase, Robinhood, OpenSea, and Binance, signaling a major shift in its approach to crypto regulation.

"Prior leadership at the SEC and throughout the government took a regulation-by-enforcement approach that stifled progress and disadvantaged the U.S. against other countries who fostered innovation through fair and transparent digital asset regulatory regimes," Kraken wrote. "This dismissal lifts that cloud of uncertainty. It reaffirms that businesses like Kraken, which prioritise compliance and consumer protection, should not be subject to arbitrary legal battles.

The Trump administration is advancing cryptocurrency initiatives by proposing a strategic reserve of digital assets, including Bitcoin, Ethereum, XRP, Solana and Cardano, and establishing a working group to develop supportive regulations.

Powering better payments in the UK

The Payments Association has set out 66 policies to support growth and innovation in the UK.

In its new manifesto, the Association sums up the recommendations of 216 payments professionals working in ESG, regulation, open banking, financial crime, digital currencies, cross-border payments and financial inclusion.

Tony Craddock, director general, said: "It’s time that the UK set out to grow and modernise our payments infrastructure to maximise its economic potential while ensuring consumer protection. It’s vital to ensure the new infrastructure and legal system underpinning it is appropriate, aligned to the vision, adaptive to change and supportive of the common goal of enabling economic growth and stability in an inclusive, liberal society."

Riccardo Tordera-Ricchi, director of policy and government relations, added: “We’re dangerously close to a stage where the US and the EU are moving ahead of the UK with regards to digital currencies. It’s our greatest hope that the government takes our policy recommendations on board and takes advantage of the growth opportunities afforded by this technology. We certainly don’t want to see the UK fall behind in the realm of payments, having led in this space for so long.”

Stripe achieves a $91.5B valuation

The financial infrastructure platform provider Stripe has signed agreements with investors to provide liquidity to current and former employees through a tender offer.

Which means it has now reached a massive $91.5B valuation.

"We attribute this year ’s rapid growth in part to our long-standing investments in building machine learning and artificial intelligence into our products," Stripe wrote in a letter to investors.

"These bets continue to pay off, increasing revenue for existing customers, encouraging more businesses to switch to Stripe, and helping new companies reach significant scale unprecedentedly quickly."

AI is becoming more affordable than new hires

Ok. So it's not all good news.

Almost three in five (57%) UK businesses have said they are more likely to use AI than hire new employees due to the rising cost of national insurance taxes and a hike in the minimum wage.

Research from Pleo found that when it comes to driving productivity, 59% of British business leaders report that it is easier to simply fire up AI than motivate their employees – rising to 82% for those using AI "extensively".

But be warned. Firing all humans will land businesses in a world of pain.

Søren Westh Lonning, Pleo's CFO, said financial teams must balance driving innovation with their duty to ensure financial stability.

"AI can make this balance possible, but this does not mean leaders should embrace it blindly," he said. "Nor should they use it to replace their teams. Financial minds, and especially financial change-makers, are not easily replaced – especially in today’s climate. But, with the right technology and leadership, they can be easily empowered.”

Crypto scam alert: Victims suffer £1million loss

Residents of Kent - a county next to London - have been urged to be on the lookout cryptocurrency fraud.

Nine victims in the region lost more than £1 million in total after their personal information was shared online following a data leak.

Personal details were taken from the data leak and used to generate fake Action Fraud reports. Scammers then posed as police officers, sent the report to victims and tricked people into handing over their seed phrase so fraudsters could steal their funds.

Detective Sergeant Darryll Paulson said: "I urge anyone contacted by someone claiming to be from a crypto host, or from the police, not to give out any personal details.

"Scammers are becoming increasingly more calculating in their methods to defraud their victims into losing a substantial amount of money and will often create urgency in the situation, such as telling them they need to act now to stop their funds from being stolen."

Western banks face "attack-as-a-service" blitzkrieg

The British biometric firm iProov has found that 60% of major Western banks are being targeted by attack-as-a-service marketplaces.

Its latest Threat Intelligence Report, which is based on the observation and analysis of worldwide criminal activity, revealed that crime-as-a-service has developed into a booming marketplace. There are now 24,000 dark web crooks selling identity attack technologies such as deepfakes, face swaps and native virtual cameras that can be used against high-value corporate targets.

"The commoditization and commercialization of deepfakes, for instance, pose a significant threat to organizations and individuals,” said Andrew Newell, Chief Scientific Officer. "What was once the domain of high-skilled actors has been transformed by an accessible marketplace of tools and services that low-skilled actors can now use with minimal technical expertise for maximum results.”

Native virtual camera attacks which trick systems into accepting fake video or images are now the the primary threat vector, iProov found, increasing by 2665% due partly to "mainstream app store infiltration."

Thanks for reading! Please get in touch with jasper@machine.news to send stories for inclusion on Money Machine or enquire about our PR and Content services.